|

柬埔寨稅法金融制度 Cambodian Tax Law Financial System

|

|||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

柬埔寨稅法金融制度

一.租稅 (一)公司營利事業所得稅 1.2003年修訂,除天然資源開發戓石油開採30%外,營利所得稅一律20%。 2.營所稅適用於所有在柬國居留納稅人,應計算營利包括個人或公司任何買賣或投資所賺取之利潤、租金或其他收入。應繳納營所稅公司、企業等法人未進行年終結算前,應於每月繳納1%營業收入,作為預繳營所稅,該預交稅款應在每月15日前繳納。當年無法扣抵時可轉入下年度。 3.計算營利所得稅時,下列支出可視為費用,予以扣減: (1)預繳稅(2)員工薪資、租金(3)固定資產折舊(4)慈善捐款(最多佔5%) 4.獎勵投資案營所稅至少享有3年免稅期,依各行業不同,如旅遊業4年、農業及工業5年;基礎建設及大型農業投資案6年。免稅期由企業首度獲利或營運3年後才開始計算,實際免稅期6至9年。 5.合格之投資案進口建材、原物料、設備、半成品等得免課進口稅。 (二)個人所得稅 1.柬埔寨居民、境內外國人所得均需繳納,其個人所得稅表如次:

2.非柬埔寨居民(居住非滿182天者),僱用者需就源扣繳預繳稅20%。 (三)加值營業稅(VAT) 1999年起課徵加值營業稅,其適用稅率情況如次: 1.加值營業稅10%: 2.加值營業稅0%: 3.不課徵加值營業稅: 4.加值營業稅需每月20日前申報,且加值營業稅係向最終消費者課徵,若納稅義務人應繳加值營業稅較已收取加值營業稅低時,可申請退稅。 (四)預繳所得稅(withholding tax) 1.柬埔寨境內支付,下列情況需先繳預繳稅:

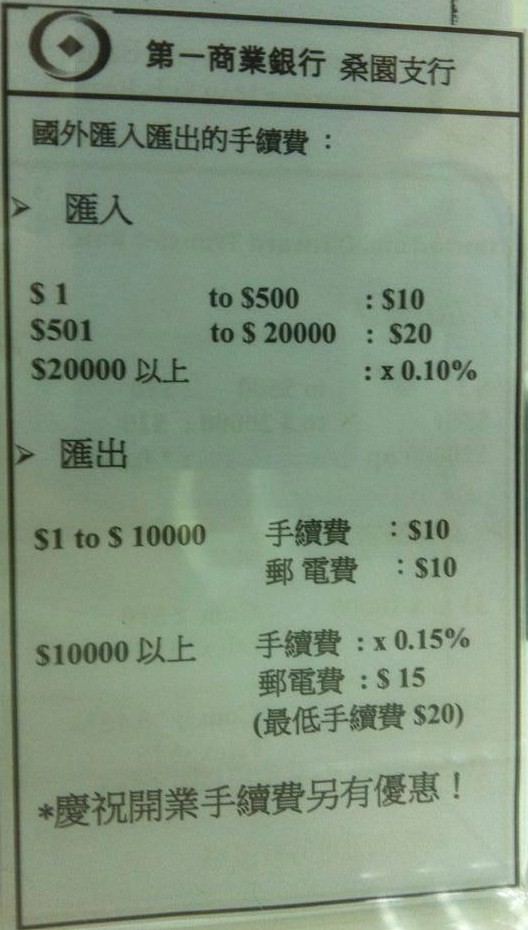

2.支付柬埔寨境外或非居民之利息、權利金、租金、股利及提供技術服務或管理之薪資:14%。 ※小叮嚀:收租在柬埔寨開戶,稅法規定,境內支付租賃所得稅10%;如直接匯入台灣帳戶,支付境外租賃所得稅14%。 (五)部份商品與服務特別稅

(六)進出口關稅 1.按商品級別及種類劃分為0%、7%、15%、35%: 2.部分產品出口向出口商課徵出口稅,包括已加工木材(5-10%)、橡膠(2-10%)、海產品及未切割石材(10%)。 二.金融 (一)金融制度 實行開放金融政策,初期怕外國人沒有信心,每家銀行均可向國家銀行申請入股,1996年後,政治與經濟穩定,政府國營股份退出,變成全私有制。外資銀行可100%持股或建立分支機構、代表處。無外匯管制,廠商可自由匯出匯入,因為國際洗錢法約束,現金管制,超過一萬美元需要審查。 (二)外商貸款管道及利率水準 目前柬國有30餘家商業銀行,專業銀行7家,外國銀行代表處3家,小型金融機構25家,其中8家外資銀行(2家馬商、1家新商、1家澳商、3韓商及1台商)。我國第一銀行1998年於金邊設立分行,協助台商取得融資及押匯等業務,兆豐銀行2011年在金邊設立分行。柬僑方僑生的加華銀行與公私合資的柬埔寨外貿銀行等前5大銀行資產佔銀行總資產60%,儲蓄存款70%與提供貸款70%。其他外商銀行可提供外商貸款服務,目前一般銀行僅承作不動產(土地)抵押貸款,美金貸款利率約在8-12%。 三.匯兌 允許居民自由持有外匯不受限制,單筆轉帳金額在1萬美元(含)以上,授權銀行應向國家銀行報告。採用自由浮動匯率,是世界上除美國外,美元可以直接在市場流通的少數國家之一。幣值為RIEL,與美金匯率約:1USD= 4015R,大宗交易均用美元,當地貨幣僅在小額交易或零錢才使用到。 |

||||||||||||||||||||||||||||||||||||||||||||||||

Cambodian Tax Law Financial System |

0 - 500,000 RILE(USD128)=Monthly salary of basic salary |

0% |

500,001 - 1,250,000 RILE(USD320) |

5% |

1,250,001 - 8,500,000 RILE(USD2,179) |

10% |

8,500,001 - 12,500,000 RILE(USD3,205) |

15% |

12,500,001 RILE(USD3,205)以上 |

20% |

2. Non -Cambodian residents (those who live in non -living for 182 days), employees need to pay 20%of the pre -paid tax payment for the source.

(3) Value -added business tax (VAT)

Since 1999, the value -added business tax is levied, and its applicable tax rate is as follows:

1. 10%of the business tax increase:

(1) Selling goods or providing services (2) Input goods entering 10%of Cambodian customs supervision.

2. Value -added business tax 0%:

(1) Export goods (2) Provide services or consumers outside the border of Cambodia (3) International freight or passenger transportation

(4) Commodities or services related to exported goods or international passenger transportation

3. Do not levy value -added business tax:

(1) Public mailing services (2) Medical (including dental medicine) and related services (3) Public transportation services (4) Insurance services (5) Basic financial services (6) Personal supplies of imported tariff -free obligations (7) Public interests related to public interests Non -profit activities are agreed by the Ministry of Finance and Economics of Cambodia.

4. The value -added business tax must be declared before the 20th of each month, and the value -added business tax system is levied to the final consumer. If the taxpayer shall pay the value -added business tax lower than that of the value -added operating tax, the tax refund may be applied.

(4) Prepaid income tax (withholding tax)

1. Payment in Cambodia, the following situations need to be paid pre -payment:

Application |

Prepaid tax rate (%) |

Natural persons provide labor income |

15 |

Management and consulting service income |

15 |

Smart property rights, rights income |

15 |

Lease income |

10 |

Fixed deposit interest paid by domestic banks or deposit institutions |

6 |

Natural person current deposit interest |

4 |

2. Pay the interest, rights, rents, dividends, and technical services or management salaries of non -residents outside Cambodia: 14%.

※ Xiao Dingzhang: The tax collection is opened in Cambodia. The tax law stipulates that the domestic payment income tax is 10%; if it is directly remitted into the Taiwan account and pays 14%of the overseas lease income tax.

(5) Special taxes for some commodities and services

Application |

Special tax rate (%) |

Small cars and its parts (greater than 2,000cc) |

80-110 |

Small cars and its parts (less than 2,000cc) |

15-45 |

Large cars, such as bus and truck |

10 |

Motorcycles and its parts (greater than 124cc) |

45 |

Fuel product |

33 |

Soda and non -alcoholic beverages |

10 |

Beer, wine and alcoholic drinks |

20 |

cigarette |

10 |

cigar |

25 |

Hotels and entertainment |

10 |

International Airlines Ticket Service |

2 |

(6) Import and export tariffs

1. Divided by the product level and types to 0%, 7%, 15%, and 35%:

(1) Applicable 0 %products are mostly products that need to be imported in Cambodia, such as agricultural equipment, raw materials, drugs, etc.

(2) Applicable 7%products are raw materials and daily necessities, such as cement, steel, sugar, bicycles, clothes

(3) Applicable 15%products are mostly machinery and equipment

(4) 35%of products are mostly final consumption wealth and luxury goods, such as television, audio, tobacco and alcohol.

2. The export tax of some products is levied to exporters, including processed wood (5-10%), rubber (2-10%), seafood and unspecified stone (10%).

2. Finance

(1) Financial system

In the early days of an open financial policy, foreigners are afraid of having no confidence in foreigners. Each bank can apply to state banks to invest in shares. After 1996, political and economic stability, government state -owned shares withdrew, and became full private ownership. Foreign banks can hold 100%shares or establish branches and representative offices. Without foreign exchange control, manufacturers can freely remit and remit, because the International Money Laundering Law and cash control, more than 10,000 US dollars need to be reviewed.

(2) Foreign loan pipelines and levels of interest rates

At present, there are more than 30 commercial banks in Cambodia, 7 professional banks, 3 foreign bank representatives, and 25 small financial institutions, including 8 foreign banks (2 horses, 1 new business, 1 Australian merchant, 3 Korean, 3 Korean Business and 1 businessman). my country's First Bank established branches in Phnom Penh in 1998 to assist Taiwanese businessmen to obtain financing and foreign exchange business. Zhaofeng Bank established branches in Phnom Penh in 2011. The top 5 major banks including Cambodia ’s overseas Chinese and Cambodian Foreign Trade Banks, which are joint ventures, account for 60 % of the total assets of banks, and 70 % of savings deposits and 70 % of savings deposits. Other foreign banks can provide foreign loan services. At present, the general banks are only for real estate (land) mortgage loans, and the US dollar loan interest rate is about 8-12 %.

3. Exchange

The residents are allowed to hold foreign exchange freely and are not restricted. The amount of transfer of a single transfer is more than $ 10,000 (inclusive), and the authorization bank shall report to the State Bank. The use of free floating exchange rates is one of the few countries that can be circulated in the market in the world except the United States. The currency value is RIEL, and the exchange rate of the US dollar is about: 1usd = 4015R. Both transactions are used in US dollars. Local currencies are only used in small transactions or change.

柬埔寨投資及稅制簡介

柬埔寨於1999年成為東協第十個會員國,並於2004年加入世貿組織(WTO),經濟政策甚為開放,除不動產、出版事業及媒體經營等行業外,大部份行業均開放外資百分之百經營,加上身為東協會員國,因此具有區域性貿易優惠,且美、日、歐盟等31國優惠關稅待遇,商品降低成本具有價格競爭優勢。

該國產業依照GDP比重排序:服務業、農業、製造業。目前境內主要投資國:中國、南韓、馬來西亞、英國及美國等,投資項目以民生用品及人力資源低價且豐沛之勞力密集的紡織成衣業為主,美元可直接在市場流通。

柬埔寨目前主要投資相關依據法令主要為2003年通過之「柬埔寨王國投資法修正案」及柬埔寨商業法規。依據法令及設立型態,外國投資人在柬埔寨設立企業的型態可分為辦事處、外國公司之分公司、私人有限公司、公眾有限公司、合夥企業及獨資企業等六種型態。

柬埔寨稅制,無論係個人或公司,居住者需就國內及國外所得申報納稅,而非居住者僅需就柬埔寨來源所得課稅。個人稅部分,其薪資採逐月扣繳,無須做年度申報。公司所得稅,一般行業稅率為20%,納稅義務人應於每月預先繳納營業收入1%作為所得稅,課稅所得包含營業利潤(包含資本利得)、投資收益、利息、租金收入以及權利金。柬埔寨亦提供多樣之租稅優稅,符合資格投資案件可享有特殊折舊率或至多六年免稅期間、營業損失往後遞延五年、可免予繳納每個月1%預繳所得稅、機器設備及原料進口免關稅等優惠。

柬埔寨於1999年起課徵加值營業稅,一般稅率為10%,每月20日前需向政府申報。股利、利息、權利金、租賃所得及服務費用等,則依居住者及非居住者身分,需於給付時扣繳10%~15%不等之扣繳稅款。

其他稅負部分,柬埔寨每年尚須就不動產價值超過25,000美元之部分課徵0.1%財產稅,並就未使用土地課徵2%未使用土地稅。不動產/動產持有者須就租賃所得由承租人扣繳10%財產出租稅。其他稅負尚有針對不動產及交通工具等所有權移轉課徵4%登記稅、對柬埔寨公司股份及與政府簽訂之服務及商品之合約課徵0.1%登記稅及牌照稅等。

柬埔寨目前並未與任何國家簽立租稅協定。故就租稅規劃之角度而言,並無特定有效率之投資架構。若以台灣母公司稅負遞延效果之考量,則可以海外控股公司間接投資。

資料來源:勤業眾信聯合會計師事務所會計師廖哲莉、勤業眾信聯合會計師事務所經理韓馥璟

Introduction to investment and tax system in Cambodia

Cambodia became the tenth member of the Association of Southeast Asian Nations in 1999 and joined the World Trade Organization (WTO) in 2004. Its economic policy is very open. Except for industries such as real estate, publishing and media operations, most industries are open to 100% foreign investment. In addition, as a member of the Association of Southeast Asian Nations, it has regional trade preferences, and 31 countries such as the United States, Japan, and the European Union have preferential tariff treatment, and the cost reduction of commodities has a price competitive advantage.

The country's industries are ranked according to the proportion of GDP: services, agriculture, and manufacturing. At present, the main investment countries in the territory are: China, South Korea, Malaysia, the United Kingdom, and the United States. The investment projects are mainly the textile and garment industry with low-cost and abundant human resources for people's livelihood and human resources. The US dollar can be directly circulated in the market.

At present, the main investment-related laws and regulations in Cambodia are mainly the "Amendment to the Investment Law of the Kingdom of Cambodia" passed in 2003 and Cambodian commercial regulations. According to laws and establishment types, the types of foreign investors establishing enterprises in Cambodia can be divided into six types: offices, branches of foreign companies, private limited companies, public limited companies, partnerships, and sole proprietorships.

The Cambodian tax system, whether it is an individual or a company, residents need to declare tax on domestic and foreign income, while non-residents only need to tax income from Cambodian sources. For the personal tax part, the salary is withheld monthly, and no annual declaration is required. Corporate income tax, the general industry tax rate is 20%, and the taxpayer should pay 1% of the business income as income tax in advance every month. The taxable income includes business profits (including capital gains), investment income, interest, rental income and royalties. Cambodia also provides a variety of tax incentives. Qualified investment cases can enjoy special depreciation rates or a tax-free period of up to six years, business losses can be deferred for five years, and can be exempted from paying 1% monthly prepaid income tax, machinery and equipment and tariff-free import of raw materials.

Cambodia began to levy value-added business tax in 1999, the general tax rate is 10%, and it needs to be declared to the government before the 20th of each month. Dividends, interest, royalties, rental income and service fees, etc., are required to withhold tax ranging from 10% to 15% when paying according to the status of residents and non-residents.

As for other tax burdens, Cambodia still needs to levy 0.1% property tax on the portion of the real estate value exceeding US$25,000 every year, and levy 2% unused land tax on unused land. Owners of immovable/movable property are required to withhold 10% property rental tax on rental income from the lessee. Other tax burdens include a 4% registration tax on the transfer of ownership of real estate and vehicles, and a 0.1% registration tax and license tax on the shares of Cambodian companies and contracts with the government on services and goods.

Cambodia does not currently have a tax treaty with any country. Therefore, from the perspective of tax planning, there is no specific and efficient investment structure. In consideration of the tax deferral effect of the parent company in Taiwan, indirect investment can be made by overseas holding companies.

Source: Liao Zheli, accountant of Qinye Zhongxin United Accounting Firm, Han Fujing, manager of Qinye Zhongxin United Accounting Firm

上一頁Last |

下一頁Next |

TOP |

.......热点省份代理人 詹经理 Rock Chan

.......热点省份代理人 詹经理 Rock Chan